Macroeconomics behind Sri Lanka’s Economic Downturn

In addition to the impact of the Covid-19 outbreak, the Sri Lankan economy has been experiencing one of its worst-ever economic crises as a result of mishandled government finances and ill-timed tax cuts.

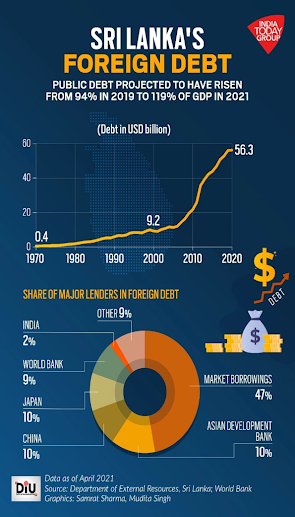

Huge foreign debt stacks, a series of lockdowns, skyrocketing inflation, fuel shortages, a drop in foreign currency reserves, and currency devaluation have all harmed the country's economic growth.

Fiscal dominance, high deficits, and government debt have characterized Sri Lanka's macroeconomic landscape. This has resulted in considerable macroeconomic volatility, as seen by the country's periodic balance-of-payments issues and instability.

What are Macroeconomic factors?

Economies flourish and fall as a result of both internal and external variables beyond the control of governments and their citizens. These variables referred to as macroeconomic factors, characterize the occurrences that alter a country's financial outlook.

Macroeconomic factors are broad indicators of an economy's financial growth or deterioration. A macroeconomic factor is a geopolitical, environmental, or economic event that has the potential to affect monetary stability in a country, rather than a specific segment of the population.

Macroeconomic factors include inflation, gross domestic product (GDP), national income, unemployment rates, etc.

1). Inflation

In February 2022, year-on-year inflation accelerated to 17.5 percent, owing mostly to high food inflation of 24.7 percent, rising global commodity prices, gasoline price adjustments, and partial monetization of the budget deficit. Furthermore, between May and November, an agrochemical import embargo hampered agricultural output. The increase in prices impacted households' capacity to afford living expenses, resulting in a decline in welfare and increased food insecurity. To alleviate the tensions, the central bank has hiked policy rates and the statutory reserve ratio by 200 basis points since August 2021.

2). Fiscal Deficit

In 2021, the budget deficit is expected to remain at 11.1 percent of GDP, while public and publicly insured debt is expected to reach 117 percent of GDP. Domestic resources, particularly the central bank, were mostly used to fund the fiscal deficit. Fitch, S&P, and Moody's all cut the sovereign rating, putting it in the high-risk category.

3). GDP

The coronavirus pandemic has wreaked havoc on the tourism industry, which accounts for about 10% of the country's GDP and generates foreign cash. As a result, foreign exchange reserves have dropped from over $7.5 billion in 2019 to over $2.8 billion in July. As the supply of foreign exchange has dried up, the amount of money that Sri Lankans have had to spend to purchase the foreign exchange needed to import things has skyrocketed. As a result, the Sri Lankan rupee has lost about 8% of its value so far this year. It should be highlighted that the country's basic food supply is mainly reliant on imports. As a result, food prices have grown in Synch with the rupee depreciation.

Only time will tell whether or not receiving Rapid Financing Instrument (RFI) from the International Monetary Fund(IMF), will help Sri Lanka’s economy is taking an Upward turn or not.

----Author - Astha Singh

Comments

Post a Comment