ABCs of NON-BANKING FINANCIAL COMPANIES

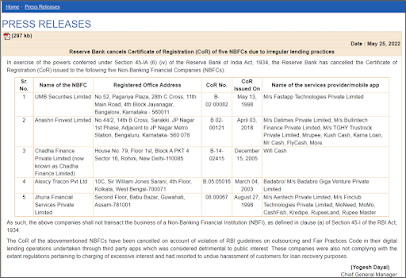

In the light of the Reserve Bank of India canceling the certificate of registration (CoR) of 5 non-banking financial corporations, owing to their irregular lending practices and other allied reasons, here’s an article detailing the ABCs of NBFCs.

Picture credit: https://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=53763

Definition:

According

to the official website of the Reserve Bank of India, a Non-Banking Financial

Company (NBFC) is a company registered under the Companies Act, 1956 engaged in

the principal business of loans and advances, acquisition of

shares/stocks/bonds/debentures/securities issued by Government or the local

authority.

A

NBFC doesn’t include any institution whose principal business is that of

agriculture activity, industrial activity, purchase or sale of any goods (other

than securities) or providing any services and sale/purchase/construction of the immovable property.

Difference between an NBFC and a bank:

NBFCs lend and make investments and hence their

activities are akin to that of banks; however, there are a few differences as

given below:

a.

NBFC cannot accept demand deposits.

b.

NBFCs do not form part of the payment and

settlement system and cannot issue cheques drawn on themselves.

c.

Deposit insurance facility of Deposit Insurance and

Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in the case of banks. In the case of banks, if some banks default, (remember the Yes

Bank fiasco?), depositors can get back their money up to an amount of INR 1 lakh

whereas, in the case of NBFCs that do accept non-demand deposits, the entirety

of the risk rests with the depositors themselves.

The business model of NBFCs: Who lends money to NBFCs?

NBFC as specified above, do not accept

demand deposits like banks do. How else do you think they manage to exist and

make money? The answer is simple: They borrow money on one hand whilst lending

out the money on the other hand. How do they make profits you ask? NBFCs borrow

money at a lower interest rate and lend money at a higher interest rate.

To understand why anyone would lend

money to an NBFC, let us first understand that several bodies like insurance

companies, mutual fund houses, and even private organizations that have a huge

amount of surplus money in their kitty, will always be on the lookout for good

opportunities in the market, wherein they can invest their money and get good

returns. However, no organization or financial body will readily agree to

lend money to an NBFC without any form of security on the part of the

borrower.

This is where we need to understand the

concept of CP or commercial papers. Commercial papers are nothing but

promissory notes that are short-term in nature with low-interest rates. It is,

in other words, a short-term debt instrument issued by companies to raise funds

generally for a period of up to a year or less. It was introduced in India for

the very first time, in the year 1990.

Having said that, it is very important to note that entities do not lend money to NBFCs based on the existence of CPs solely. After the obtainment of a CP, the entities run it by several credit rating agencies like CRISIL who rate the NBFCs based on their credibility and their performance. Based on these ratings, entities thereafter decide to lend money to the NBFCs or otherwise.

Picture credit: Business model of an NBFC: https://www.youtube.com/watch?v=hXkVmujIhmQ

Problem area of NBFCs:

NBFCs borrow money from banks or sell commercial papers to mutual funds to raise money.

This money is then given as a loan to small and medium enterprises, retail customers, and so on.

However, when NBFCs are faced with a liquidity crunch: this paves the way for an NBFC crisis.

Picture credit: Liquidity crunch: https://www.youtube.com/watch?v=wrlv2Se2L_c

What leads to the crisis in the case of

NBFCs: Why is the RBI shutting down countless NBFCs?

According to experts and analysts, the NBFC business model itself is flawed. It is known to raise short-term funds which are subsequently lent as long-term loans! For example, an NBFC raises money on a short-term basis, say, 6 months: by selling CPs. Thereafter this NBFC will be expected to pay back the money after 6 months itself – which it fails to fulfill because it has already lent out that fund as a car loan with a tenure of 5 years!

To combat this problem, NBFCs either renew the 6-month CP or raise fresh loans to repay the fund. It should be noted in this context that if and when the Indian economy is faring well enough, this solution of renewing debt papers or raising new loans works well. However, when the country faces an economic crunch, needless to say, the loop stands disrupted.

This was exactly what had happened at IL&FS back in the year 2018. IL&FS and its subsidiaries had defaulted on several loans and they were unable to repay the funds that they had borrowed from several banking houses, mutual fund bodies, etc.

This defaulting on the part of IL&FS paved

the way for fear to take over amongst lending bodies, who began speculating and

anticipating the worst: that if IL&FS stands at a chance of defaulting on

their repayment, so can other NBFCs!

Due

to this fear, many institutions refused to lend money to NBFCs. NBFCs

subsequently fail to function properly which compels the RBI to take regulatory

actions.

Picture credit: https://www.youtube.com/watch?v=wrlv2Se2L_c

Conclusion: What can be done to prevent such crises?

In the year 2019, the RBI had come up

with a 3-year roadmap to improve the extent and quality of supervision and

regulatory control that it can exercise overall its entities. This roadmap

which goes by the name of Utkarsh adopts the central idea of the RBI playing a

proactive role and taking a pre-emptive action to avoid any sort of crisis like

the IL&FS debt defaulting crisis or the RBI canceling the CoRs of NBFCs

owing to erratic lending practices.

Such remedial actions can definitely be

adopted to prevent similar crises as far as NBFCs are concerned.

---- Author Sneha Das

A good read

ReplyDelete